Mortgage loans statistics – October 2021

Mortgage loans statistics – October 2021

According to statistics released today by the Monetary Authority of Macao, new approvals of residential mortgage loans (RMLs) and commercial real estate loans (CRELs) both decreased in October 2021. With regard to the outstanding balances, RMLs dropped whereas CRELs witnessed an increase.

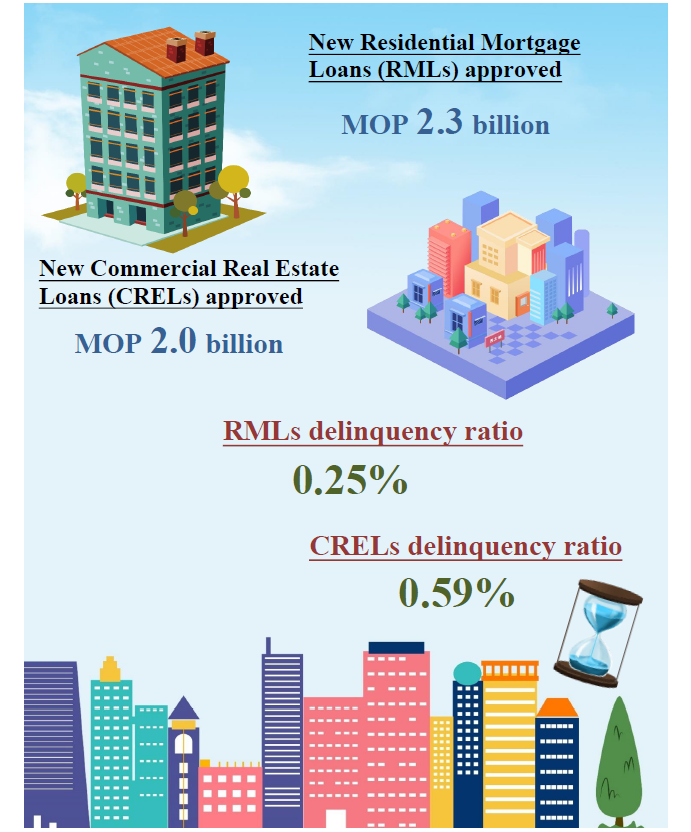

New lending approved

In October 2021, new RMLs approved by Macao banks dropped by 32.2% month-to-month to MOP2.33 billion. Of which, new RMLs to residents, representing 99.9% of the total, fell by 31.1% to MOP2.33 billion; the non-resident component also decreased to MOP1.6 million. The monthly average of new RMLs approved between August and October 2021 was MOP3.1 billion, down by 16.2% from the previous period (July to September 2021).

New RMLs collateralised by uncompleted units (i.e. equitable mortgage) fell month-to-month by 47.6% to MOP204.4 million. On an annual basis, new equitable mortgage approved dropped by 41.5%.

New CRELs fell by 36.6% month-to-month to MOP1.96 billion. Within this total, new CRELs to residents, which occupied 99.1% of the total, decreased by 33.8% to MOP1.95 billion; new CRELs to non-residents also dropped to MOP16.9 million. The monthly average of new CRELs approved between August and October 2021 was MOP3.0 billion, a decrease of 50.5% from the previous period (July to September 2021).

Outstanding balances

As at end-October 2021, the outstanding value of RMLs decreased by 0.2% month-to-month but rose by 1.1% from a year earlier to MOP237.2 billion, attributable to the repayment of loans with large denomination. Of which, the resident component made up 95.0% of the loans. When compared with the previous month, outstanding RMLs to residents and non-residents dropped by 0.1% and 1.7% respectively.

The outstanding value of CRELs was MOP159.1 billion, which advanced by 0.8% from the previous month but dropped by 8.0% from a year earlier. Residents accounted for 93.3% of the loans. Compared with a month earlier, outstanding CRELs to residents and non-residents rose by 0.8% and 0.1% respectively.

Delinquency ratios

At the end of October 2021, the delinquency ratio for RMLs stood at 0.25%, which edged up by 0.01 percentage point from a month ago but down by 0.02 percentage points from a year earlier. The ratio for CRELs was 0.59%, up by 0.01 percentage point from a month ago or 0.17 percentage points from end-October 2020.