International banking statistics – march 2022

International banking statistics – march 2022

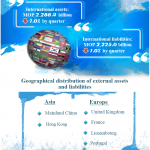

According to the statistics released today by the Monetary Authority of Macao, the proportion of international business in the local banking sector retreated in the first quarter of 2022. At end-March 2022, the share of international assets in total banking assets decreased to 86.0% from 86.3% at end-December 2021, while the share of international liabilities in total banking liabilities fell to 83.6% from 83.9%.

Non-local currencies continued to be the dominant denomination in international banking transactions. At end-March 2022, the shares of the pataca in total international assets and total international liabilities were 1.0% and 0.7% respectively. The Hong Kong dollar, the US dollar, the renminbi and other foreign currencies accounted for 30.3%, 46.4%, 17.9% and 4.4% of total international assets while their respective shares in total international liabilities were 36.9%, 39.6%, 20.2% and 2.6%.

International Banking Assets

At end-March 2022, total international assets decreased by 1.0% from a quarter ago to MOP2,288.4 billion (USD283.8 billion). Within this total, external assets dropped by 0.2% from the previous quarter to MOP1,761.5 billion while local assets in foreign currencies decreased by 3.7% to MOP526.9 billion. As a major component of international assets, external non-bank loans increased by 7.4% to MOP794.4 billion.

International Banking Liabilities

Total international liabilities decreased by 1.0% from three months ago to MOP2,225.0 billion (USD276.0 billion). Of this total, external liabilities and local liabilities in foreign currencies fell quarter-to-quarter by 0.4% to MOP1,364.3 billion and 1.9% to MOP860.7 billion respectively. Deposits taken from external banks constituted a major component of international liabilities. This type of deposits dropped by 4.3% to MOP733.4 billion at end-March 2022.

Breakdown of External Banking Assets and Liabilities by Region

The majority of external assets and liabilities of the local banking sector were related to Asia and Europe. At end-March 2022, claims on Mainland China and Hong Kong occupied 43.8% and 26.7% of total external assets, while claims on Luxembourg and Portugal took up 1.0% and 0.7% respectively. Meanwhile, claims on Portuguese-speaking countries and countries along the “Belt and Road” occupied respective shares of 1.1% and 9.3%. On external liabilities, Mainland China and Hong Kong accounted for 40.5% and 35.6% of the total respectively, while the United Kingdom and France took up corresponding shares of 4.3% and 2.7%. Portuguese-speaking countries and countries along the “Belt and Road” represented 0.5% and 9.8% respectively.

The compilation of International Banking Statistics follows the methodology advocated by the Bank for International Settlements in order to facilitate Macao SAR’s participation in the “Locational International Banking Statistics” project of the international organisation.