Coordinated Portfolio Investment Survey - 31 December 2021

Coordinated Portfolio Investment Survey - 31 December 2021

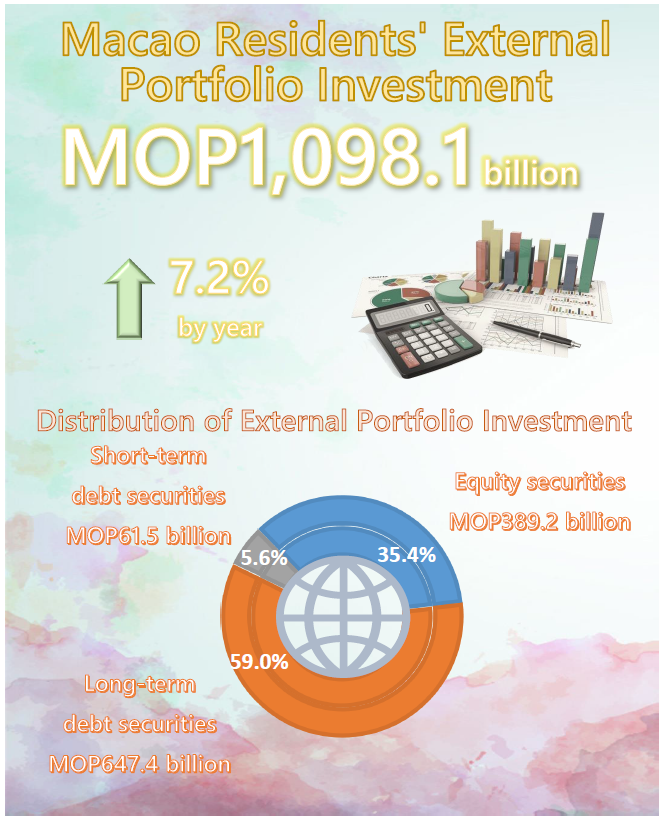

According to the statistics released today by the Monetary Authority of Macao, on 31 December 2021, investment of Macao residents (including individuals, the government and other legal entities but excluding Macao’s foreign exchange reserves) in securities issued by unrelated non-residents reached MOP1,098.1 billion at current market value, representing a rise of 1.9% from end-June 2021 or 7.2% from end-2020. Among the various instruments of portfolio investment, equity securities (including mutual funds and investment trust units), long-term debt securities and short-term debt securities were valued at MOP389.2 billion, MOP647.4 billion and MOP61.5 billion respectively. As compared with end-2020, equity securities, long-term debt securities and short-term debt securities increased by 12.4%, 4.3% and 6.6% respectively.

By geographical distribution, the Asian region continued to occupy the largest share of Macao residents’ external portfolio investment, at 54.3%. The rest was mainly placed in the North Atlantic and Caribbean (16.2%), Europe (13.4%), North America (13.0%) and Oceania (1.4%).

Investment in securities issued by Mainland Chinese entities, including those securities listed on non-Mainland exchanges, continued to assume the leading position, occupying 36.3% of local residents’ portfolio investment outside Macao. Its market value increased by 6.1% from end-2020 to MOP398.2 billion. The investment consisted of MOP132.9 billion in equity securities, MOP221.6 billion in long-term debt securities and MOP43.7 billion in short-term debt securities, taking up 34.2%, 34.2% and 71.0% of the respective total. Meanwhile, the share of investment in securities issued by Hong Kong SAR entities dropped from 13.6% to 12.2%; the corresponding market value decreased by 3.6% to MOP134.1 billion, of which equity securities and long-term debt securities amounted to MOP58.5 billion and MOP64.3 billion respectively.

The market value of Macao residents’ portfolio investment in the North Atlantic and Caribbean decreased by 0.1% from end-2020 to MOP177.4 billion while its share in total external securities investment reduced from 17.3% to 16.2%. Nevertheless, the market value of portfolio investment in the British Virgin Islands grew by 9.8% to MOP86.7 billion.

The bulk of investment in North America was placed in the United States. The market value of Macao residents’ investment in US securities increased by 17.9% from end-2020 to MOP127.0 billion while its share in total external portfolio investment rose from 10.5% to 11.6%.

Investment in European securities rose by 2.1 percentage points to 13.4% in share and increased by 26.7% to MOP147.2 billion in market value from end-2020. Among the European countries, the portfolio investment in Luxembourg, Ireland and the United Kingdom took up larger portions, valued at MOP38.8 billion, MOP30.5 billion and MOP27.8 billion respectively.

The market value of Macao residents’ investment in countries along the “Belt and Road” (excluding China) increased by 19.0% from end-2020 to MOP93.6 billion, equivalent to 8.5% of total external portfolio investment. Meanwhile, the market value of portfolio investment in Portuguese-speaking countries was MOP573.8 million, which was placed in securities issued by entities in Portugal and Brazil.

The compilation of Coordinated Portfolio Investment Survey (CPIS), jointly conducted by the Monetary Authority of Macao (AMCM) and the Statistics and Census Service (DSEC), follows the methodology advocated by the International Monetary Fund.