According to statistics released today by the Monetary Authority of Macao, newly approved small and medium-sized enterprise (SME) credit dropped in the second half of 2022. On the other hand, the outstanding balance of SME loans rebounded while the share of SME loans to major industries remained stable.

New lending approved

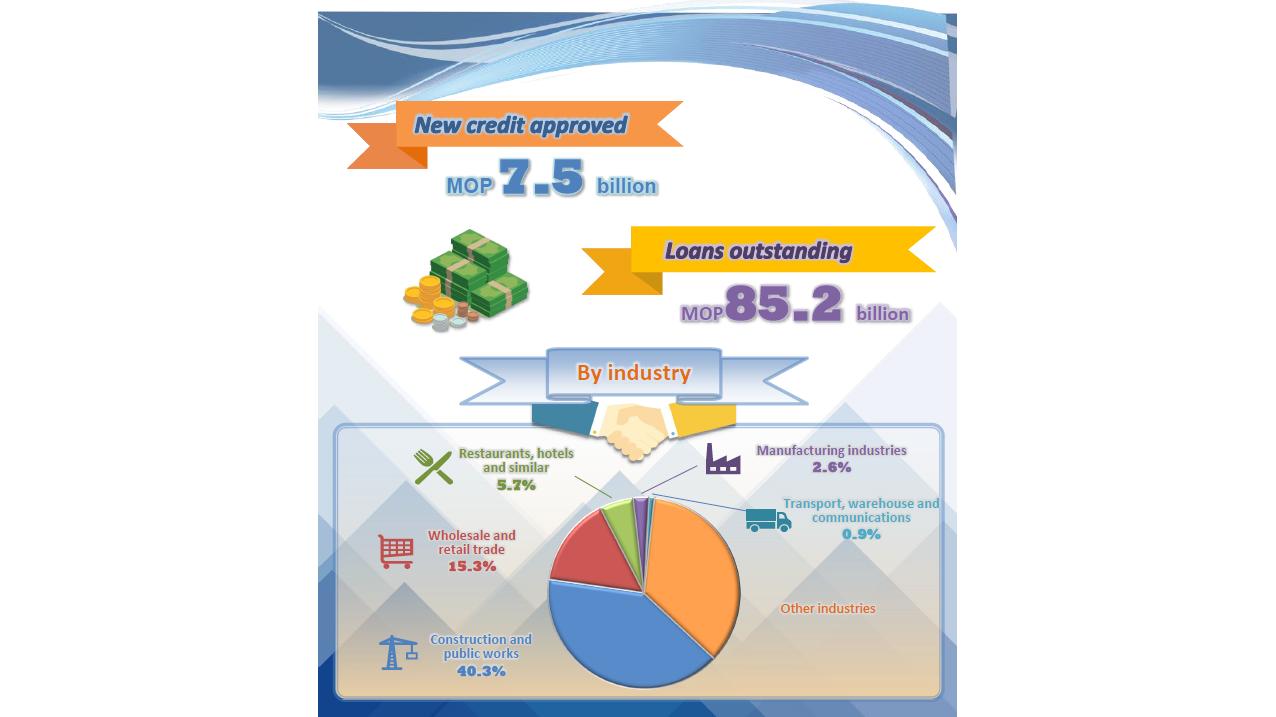

In the second half of 2022, new SME credit limit approved by Macao banks totalled MOP7.5 billion, down 0.5% from the first half of 2022. The collateralised ratio, which indicates the proportion of credit limit with tangible assets pledged, dropped 13.6 percentage points from the last survey period to 55.1%.

Credit utilisation

As at end-2022, the outstanding balance of SME loans totalled MOP85.2 billion, up 1.4% from end-June. Compared to the previous survey period, outstanding SME loans to “restaurants, hotels and similar” and “wholesale and retail trade” increased 11.3% and 5.9% respectively whereas those to “transport, warehouse and communications” decreased 4.0%.

The utilisation rate, defined as the proportion of outstanding credit balance to the credit limit granted, rose 3.1 percentage points from six months ago to 81.0%.

Delinquent loans

At end-2022, the outstanding balance of delinquent SME loans decreased 19.4% from six months ago to MOP560.6 million. The delinquency ratio, the fraction of delinquent loans to total SME loans outstanding, dropped 0.2 percentage points from end-June 2022 to 0.7%.