The payment function for the Social Security System has been launched on the "Macao One Account"

The payment function for the Social Security System has been launched on the "Macao One Account"

As of 20 April, about 14,000 employers have not yet paid Social Security System’s obligatory system contributions for their employees for the first quarter of 2023, accounting for about xx% of the total number of employers who need to pay contributions. As the payment deadline is approaching, the flow of people at service points is increasing. The Social Security Fund (abbreviated to FSS in Macao) calls on employers and residents to make more use of the “Macao One Account” mobile app or website to make the payments, so as to avoid waiting in line and not be restricted by office hours.

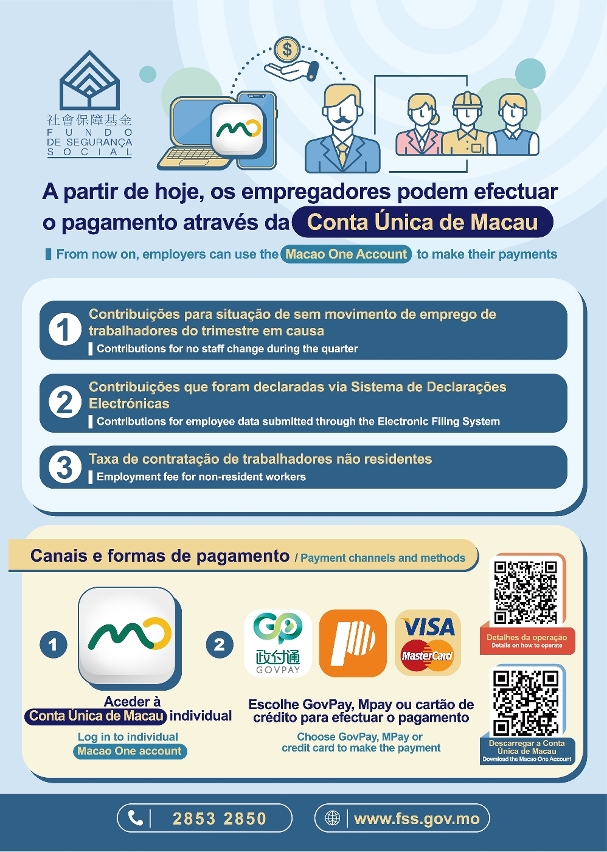

The employer’s payment function under the Social Security System was launched on the "Macao One Account" at the beginning of this month. If there is no staff change, or the employee data has been submitted via the Electronic Filing System within the time limit, these employers can pay the obligatory system contributions, and the employment fee for non-resident workers within the month through electronic methods such as the “Macao One Account”, or designated banks’ online banking. If you need to check the payment advice number and the amount payable, you can use the FSS’s online platform ( https://eservice.fss.gov.mo/Employer/cpa/Index?culture=en ), and you don’t need to visit a service point or bank in the whole process, which is both convenient and fast.

As for beneficiaries of the arbitrary system, they can also use the "Macao One Account" to pay the contributions of the arbitrary system, or through designated banks’ electronic channels and counters, JETCO network ATMs, self-service machines with social security contribution label.

According to the law, employers must pay contributions for their local employees within the month. If the payment is overdue, employers must pay a late payment interest and penalties. If a non-resident worker is hired, the employer must also pay the employment fee for this non-resident worker as well. If a beneficiary of the arbitrary system is late to pay the contributions, the overdue contributions cannot be paid unless they are paid with a late payment interest within two months after the expiration of the statutory period.

The FSS calls on the use of electronic channels for making the payment. If residents need to go to a service point, it is also recommended to use the appointment service and get a ticket number online. For relevant information, please visit the FSS’ website at www.fss.gov.mo, or call 2853 2850 during office hours.